Understanding and analyzing financial reports is an essential skill for anyone involved in business or finance. Whether you’re a small business owner or an experienced investor, the ability to interpret financial statements can illuminate opportunities for profit maximization and risk mitigation. This comprehensive guide is designed to help you navigate through the complexities of financial reports, ensuring you extract the most pertinent insights to drive your financial decision-making.

Financial reports are the accounting practices’ formal records, offering a detailed glimpse into a company’s financial status. They not only reveal the company’s past performance but also provide critical clues about its future prospects. Unlocking the potential of these reports begins with understanding the components and purposes of each section.

Understanding Financial Reports

Financial reports typically consist of three major components: the balance sheet, the income statement, and the cash flow statement. Each plays a pivotal role in providing a complete picture of a business’s finances and must be considered collectively for a comprehensive analysis. These reports not only serve internal stakeholders, such as management and employees, but are also crucial for external parties, including investors, creditors, and regulatory agencies, who rely on them to make informed decisions about the company’s financial health and future prospects.

The balance sheet provides a snapshot of what a company owns and owes at a specific point in time. It is divided into assets, liabilities, and equity, reflecting the company’s financial position on the report date. A thorough analysis of the balance sheet can inform you about the liquidity, solvency, and potential financial viability of the company. Additionally, trends observed over multiple reporting periods can highlight the company’s growth trajectory, asset management efficiency, and overall financial stability, making it easier to compare against industry benchmarks.

The Income Statement

The income statement, often termed the profit and loss statement, focuses on the company’s revenues and expenses over a specific period. It is an invaluable tool for identifying profitability trends and patterns. When analyzing an income statement, pay attention to the operating and net income, as these figures indicate the company’s efficiency in generating profit from its operations. Furthermore, breaking down revenues into segments can provide insights into which products or services are driving growth, allowing management to make strategic decisions about resource allocation and marketing efforts.

Understanding the dynamics within income statements can reveal opportunities for cost management and revenue enhancement. Look for recurring trends and anomalies that could impact current and future profitability, such as changes in sales revenue, gross margins, and net income margins. Additionally, the income statement can provide insights into the company’s operational efficiency by analyzing the cost of goods sold (COGS) and operating expenses, which can help identify areas for improvement and potential savings.

The Balance Sheet

A balance sheet analysis delves into the company’s resource allocations and financial obligations. Key items to scrutinize include current assets, long-term investments, current liabilities, and long-term debt. Observing the relationship between these elements can help assess a company’s leverage and liquidity. Moreover, evaluating the composition of assets can shed light on the company’s investment strategy and risk profile, particularly when distinguishing between tangible and intangible assets, which can have varying implications for valuation and financial stability.

Ratios such as current ratio and debt-to-equity ratio derived from the balance sheet are critical in evaluating financial health. These metrics aid in understanding how effectively a company can meet its short-term obligations and how its capital structure impacts its stability. Additionally, analyzing trends in these ratios over time can provide context for financial performance, revealing whether a company is becoming more or less financially secure. It’s also important to consider industry-specific benchmarks when evaluating these ratios, as different sectors may have varying standards for what constitutes a healthy balance sheet.

Cash Flow Statement Analysis

The cash flow statement reflects the actual inflow and outflow of cash within an organization, providing insight into its operational effectiveness. Unlike the income statement, which includes non-cash accounting items, the cash flow statement shows the real cash generated or consumed by the business activities. This distinction is vital for investors and management alike, as it allows for a clearer understanding of the company’s liquidity and financial health. By focusing on cash flow, stakeholders can better assess whether the company can meet its short-term obligations and invest in future growth opportunities.

Analyzing the cash flow statement involves examining cash from operating activities, investing activities, and financing activities. Significant variances in these areas can provide valuable insights into the financial strategy and management practices employed by the company. A focus on operating cash flow is particularly important, as consistent positive cash flow indicates a company’s capability to maintain and grow its operations efficiently. Moreover, fluctuations in cash flow can signal underlying operational issues or opportunities, prompting a deeper investigation into the company’s revenue generation and expense management practices.

Investing Activities

Investing activities within the cash flow statement highlight how a company is spending its funds on long-term assets like equipment and buildings. Analyzing this section can shed light on a company’s growth strategy and reinvestment into its own business operations. For instance, a company that consistently invests in advanced technology may be positioning itself as a market leader, while one that is divesting from certain assets may be pivoting its strategy to focus on core competencies.

Monitoring changes in investment activities over time can help predict future performance trends and potential alterations in strategic direction. A higher level of investment usually hints at expansion initiatives, whereas reduced investment might indicate a focus on consolidation or enhanced operational efficiency. Additionally, understanding the nature of these investments—whether they are aimed at innovation, capacity expansion, or cost reduction—can provide further clarity on the company’s long-term vision and competitive positioning.

Financing Activities

The financing activities section reflects cash movements related to raising capital and repaying debt. By examining these details, stakeholders can understand how a company finances its operations and growth initiatives. This section is particularly telling, as it reveals the company’s reliance on external financing versus internal cash generation, which can influence its risk profile and financial stability.

Cash flows from financing activities can reveal a great deal about the company’s capital structure, giving insights into dividend payments, stock buybacks, and debt issuance or repayment patterns. A balanced approach to financing activities is crucial to ensure the company maintains healthy leverage without overburdening its financial obligations. Furthermore, the timing and terms of debt issuance can indicate management’s confidence in future cash flows, while aggressive stock buybacks may suggest that the company believes its shares are undervalued. Understanding these dynamics can provide investors with a more nuanced view of the company’s financial strategy and its implications for shareholder value over time.

Final Thoughts on Financial Analysis

Mastering the art of financial report analysis enables stakeholders to make well-informed decisions that enhance profitability and ensure long-term success. By interpreting each component of the financial reports collectively, you can derive strategic insights that drive value creation and competitive advantage.

This guide outlines the essential steps in analyzing core financial documents, equipping you with the tools to confidently explore the financial health of businesses. Combining quantitative analysis with contextual understanding allows for a nuanced view that underpins the pursuit of profit maximization.

Furthermore, it is crucial to recognize the importance of industry benchmarks and historical performance metrics in financial analysis. By comparing a company’s financial ratios against those of its peers or against its own past performance, analysts can identify trends, strengths, and weaknesses that may not be immediately apparent from the raw data alone. This comparative analysis not only highlights areas for improvement but also helps in setting realistic goals and expectations for future performance.

Additionally, understanding the broader economic environment and its potential impact on financial outcomes is essential. Factors such as market conditions, regulatory changes, and technological advancements can significantly influence a company’s financial trajectory. By integrating macroeconomic indicators into your analysis, you can better anticipate challenges and opportunities that may arise, allowing for more strategic planning and proactive decision-making. This holistic approach to financial analysis ultimately empowers stakeholders to navigate complexities with greater confidence and foresight.

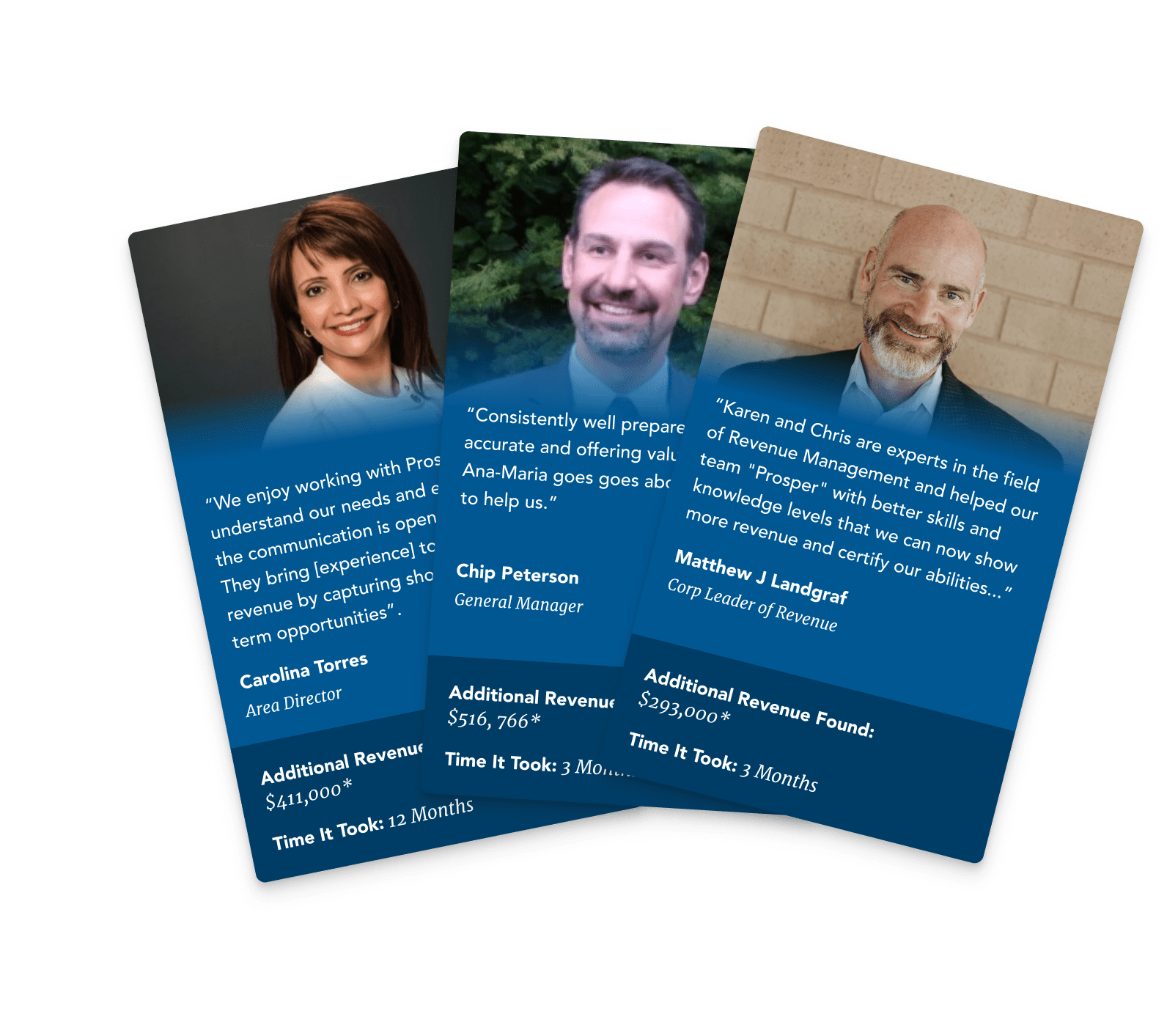

Maximize Your Hotel’s Financial Success with Prosper Hotels

Now that you’re equipped with the knowledge to analyze financial reports for profit maximization, take the next step in enhancing your hotel’s financial performance with Prosper Hotels. Our specialized services in revenue management, digital marketing, and group housing are designed to elevate your hotel’s revenue and ensure the satisfaction of your team. Learn More about how our experienced professionals can assist you in achieving and surpassing your financial goals.

Drive More Hotel Revenue

Through Untapped Strategies

Drive More Hotel Revenue

Through Untapped Strategies