In today’s competitive business environment, the ability to accurately analyze financial reports is crucial for organizations seeking to implement effective cost reduction strategies. The discipline involves a detailed examination of a company’s financial statements to identify areas where expenses can be minimized or resources can be optimized.

Understanding the nuances of financial reports can empower decision-makers to implement cost-saving measures that improve the financial health of the organization. This article provides a comprehensive guide on how to leverage financial reports for reducing costs effectively.

Understanding Financial Reports

Financial reports are essential documents that provide insights into the financial health of a business. They include detailed records such as balance sheets, income statements, and cash flow statements, which collectively offer a complete picture of financial performance. These reports serve not only as a tool for internal management but also as a means of communication with external stakeholders, including investors, creditors, and regulatory agencies. A well-prepared financial report can enhance a company’s credibility and foster trust among its stakeholders.

For effective cost reduction, it is vital to understand these documents’ key elements and how they interconnect. Mastering the interpretation of these reports allows business leaders to make informed financial decisions that impact profitability and operational efficiency. Additionally, a deep understanding of financial reports can empower teams to identify trends, forecast future performance, and develop strategic initiatives that align with the company’s long-term goals.

Key Components of Financial Reports

Each financial report consists of various components that provide specific insights into different aspects of the business. The balance sheet, for example, summarizes the company’s assets, liabilities, and shareholders’ equity. This snapshot helps in assessing the company’s financial stability and operational effectiveness at a given point in time. It is also instrumental in evaluating the company’s liquidity, solvency, and overall capital structure, which are critical for making strategic investment decisions.

The income statement, on the other hand, details the company’s revenue and expenses over a particular period, highlighting areas that might require cost-reduction methods. Understanding these components is crucial, as they form the foundation for any analysis performed on financial data. Furthermore, the income statement can reveal trends in revenue growth and expense management, providing insights into the company’s operational efficiency and profitability margins. This information is invaluable for identifying potential areas for improvement and optimizing resource allocation.

Importance of Accurate Financial Data

Accurate financial data is the bedrock of effective analysis. Ensuring that financial reports are error-free and up-to-date is paramount, as incorrect data can lead to flawed analysis and subsequently poor decision-making. Organizations must implement robust financial data collection and verification systems to maintain accuracy. Regular audits and reconciliations can help identify discrepancies early on, allowing companies to address issues before they escalate into larger problems.

By prioritizing data accuracy, companies minimize the risk of making ill-informed cost-cutting decisions, thereby protecting and potentially enhancing their financial stability. Moreover, accurate financial reporting fosters transparency and accountability within the organization, encouraging a culture of integrity and ethical financial practices. This commitment to accuracy not only strengthens internal operations but also enhances the company’s reputation in the marketplace, attracting potential investors and partners who value reliability and sound financial management.

Identifying Cost Drivers

To effectively reduce costs, it is essential to identify the primary drivers that influence expenses. Cost drivers are activities or factors that incur costs, and understanding them is key to implementing successful cost-reduction strategies. These drivers can vary widely across different industries and can include everything from labor costs and materials to overhead and operational inefficiencies. By taking a comprehensive approach to identifying these cost drivers, businesses can gain valuable insights into their financial structure and make informed decisions that enhance profitability.

Once cost drivers are identified, businesses can develop targeted strategies that focus on controlling or eliminating unnecessary expenses. This might involve renegotiating contracts with suppliers, investing in technology to streamline operations, or even retraining staff to improve productivity. The goal is to create a sustainable cost management plan that not only addresses current expenses but also anticipates future financial challenges, ensuring long-term viability.

Fixed vs. Variable Costs

Distinguishing between fixed and variable costs is crucial for organizations aiming to cut costs. Fixed costs remain constant regardless of business activity levels, such as rental payments or salaries. Conversely, variable costs fluctuate with production volume or service delivery, such as raw material costs. Understanding this distinction allows businesses to make strategic decisions about scaling operations; for instance, during periods of low demand, companies may focus on reducing variable costs to maintain profitability without the burden of fixed expenses.

By analyzing these costs, companies can identify which areas are more flexible and where adjustments can be made to reduce overall expenditures without significantly impacting operations. For example, a business might explore options for outsourcing certain functions that incur high variable costs or consider implementing just-in-time inventory systems to minimize holding costs. This nuanced understanding of cost structures can empower organizations to navigate economic fluctuations more adeptly.

Analyzing Direct and Indirect Costs

Cost analysis also involves distinguishing between direct and indirect costs. Direct costs are those that can be directly traced to a product or service, like direct labor or materials, while indirect costs are non-traceable overheads such as utilities or administrative expenses. Recognizing the interplay between these cost types is vital for accurate budgeting and financial forecasting, as it allows businesses to allocate resources more effectively and identify areas for potential savings.

Identifying these costs can help in pinpointing opportunities for cost savings, particularly in reducing unnecessary indirect expenses that do not directly contribute to the revenue generation process. For instance, a company might find that its administrative costs are disproportionately high compared to industry standards, prompting a review of processes and systems in place. Additionally, implementing cost-tracking software can provide real-time insights into both direct and indirect costs, enabling businesses to make data-driven decisions that enhance operational efficiency and drive down overall expenses.

Techniques for Analyzing Financial Reports

Various techniques can be applied to analyze financial reports effectively. Each technique offers unique insights into the company’s financial performance and potential areas for cost reduction.

Employing a combination of these methods allows for a comprehensive understanding of financial data and the formulation of effective cost-reduction strategies.

Ratio Analysis

Ratio analysis is a quantitative method of gaining insight into a company’s efficiency, liquidity, and profitability by analyzing financial statement ratios. Commonly used ratios include profitability ratios, liquidity ratios, and leverage ratios, each measuring different financial aspects.

By using ratio analysis, businesses can benchmark their performance against industry standards, identify financial strengths and weaknesses, and make informed decisions regarding cost-control measures.

Trend Analysis

Trend analysis involves examining historical financial data to identify consistent patterns or trends over time. This technique can reveal whether expenses are increasing or decreasing, enabling organizations to anticipate future financial challenges or opportunities.

Understanding these trends can help businesses proactively adjust budgets and optimize resources, leading to more effective cost management.

Variance Analysis

Variance analysis compares actual financial performance with budgeted figures to identify discrepancies. It helps management understand why variances occur, whether from price shifts, inefficiencies, or unexpected expenses.

By addressing the root causes of variances, organizations can implement corrective measures to improve cost efficiency and financial performance.

Strategies for Cost Reduction

Once financial reports have been thoroughly analyzed, and cost drivers identified, it is crucial to develop and implement strategies that focus on reducing those costs. These strategies should be tailored to the unique needs and contexts of the organization.

Effective strategies encompass various efforts across operations, procurement, and technological frameworks.

Streamlining Operations

Streamlining operations is a powerful strategy for cost reduction. It involves simplifying or eliminating unnecessary processes to enhance efficiency and reduce waste. Techniques such as lean management and process automation can significantly cut operational costs.

By focusing on efficiency, companies can maintain or even improve product or service quality while simultaneously reducing expenses.

Negotiating with Suppliers

Supplier negotiations can significantly impact cost reduction efforts. Building strong relationships with suppliers and engaging in effective negotiation tactics can lead to better pricing, favorable terms, and discounts for bulk purchases.

Establishing long-term partnerships can also ensure supply chain stability and cost predictability.

Implementing Technology Solutions

Technology plays a critical role in reducing costs by optimizing various business processes. Implementing technology solutions like cloud computing, automation tools, and artificial intelligence can increase efficiency, reduce human error, and lower operational costs.

These advances allow for more strategic allocation of resources and enable businesses to focus on core competencies, driving overall cost savings.

Monitoring and Reviewing Cost Reduction Efforts

It’s important for organizations to continuously monitor and review their cost reduction initiatives to ensure they remain effective over time. Regular evaluation helps identify new cost-saving opportunities and adjust strategies to changing market conditions.

By maintaining oversight on cost reduction efforts, companies can sustain financial health and competitive advantage.

Setting Benchmarks and KPIs

Establishing clear benchmarks and key performance indicators (KPIs) is critical for monitoring progress against cost reduction goals. These metrics provide measurable targets that can be used to assess the effectiveness of strategies and initiatives.

With clearly defined KPIs, organizations can focus their efforts on achieving specific objectives, ensuring all team members align with the cost reduction vision.

Regular Financial Audits

Conducting regular financial audits is essential in ensuring the integrity of financial reports and the success of cost reduction strategies. Audits can uncover discrepancies, fraud, or inefficiencies that may be hampering efforts.

Regular auditing ensures continuous improvement as it forces businesses to stay accountable and transparent, creating confidence among investors and stakeholders.

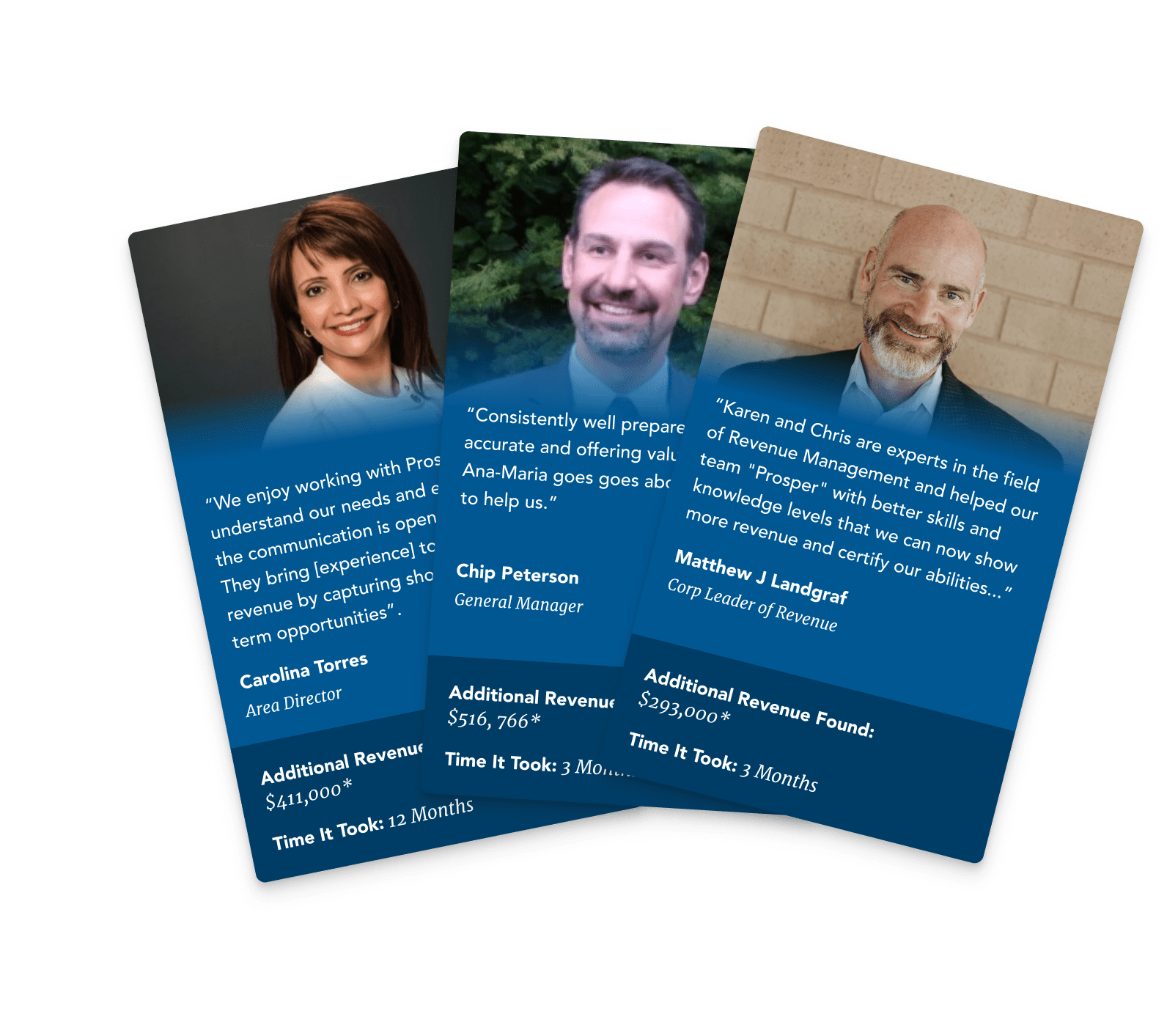

Maximize Your Hotel’s Financial Performance with Prosper Hotels

Understanding how to analyze financial reports for cost reduction is just the beginning. At Prosper Hotels, we specialize in elevating your hotel’s financial success through comprehensive revenue management, innovative digital marketing, and streamlined group housing services. Our dedicated professionals are ready to help you unlock new opportunities for revenue growth and enhance your team’s satisfaction. Learn More about how we can assist in achieving your hotel’s maximum potential today.

Drive More Hotel Revenue

Through Untapped Strategies

Drive More Hotel Revenue

Through Untapped Strategies